In exploring the world of marina real estate investment, we recognize the unique appeal and potential rewards that come with owning a slice of waterfront property.

Marinas offer a distinctive blend of leisure and business opportunities, attracting both seasoned investors and newcomers alike.

Understanding the complexities involved in marina investments is crucial for navigating this specialized market effectively.

As we delve into this fascinating sector, our focus is on the various challenges that investors may face.

From market fluctuations to the intricacies of operational management, investing in marinas requires a careful and informed approach.

Our goal is to equip fellow investors with valuable insights, enhancing their ability to make sound decisions in this dynamic environment.

1) High Entry Costs

When considering investment in marina real estate, one of the primary challenges we face is the high entry costs.

Unlike other commercial real estate sectors, launching a marina requires significant initial capital.

The costs of acquiring waterfront land, which often comes at a premium, combined with the expenses of permits and development, quickly add up.

The expenses do not stop at purchasing the land, though.

Building the necessary infrastructure, such as docks, slips, and amenities, demands further investment.

These structures are crucial for the operation and success of the marina, yet they can be cost-prohibitive, particularly in regions with strict environmental regulations.

We must also factor in operational setup costs.

Developing a well-functioning marina includes employing staff, starting marketing initiatives, and implementing systems for management.

These components are essential to attract and retain clients, but require financial resources from the outset.

The ongoing maintenance of a marina is another considerable investment area.

The proximity to water exposes infrastructure to unique wear and tear, leading to frequent repairs and upgrades.

Ensuring that our facilities remain safe and appealing to customers is crucial, yet it adds to the cumulative cost burden.

Lastly, barriers such as zoning laws and regulatory compliance can further inflate expenses.

Navigating through the bureaucratic landscape to obtain necessary approvals involves time and cost, often involving specialized consultants or legal experts.

High entry costs remain a significant barrier, requiring careful financial planning and a clear understanding of the marina industry’s nuances.

2) Weather Vulnerability

Weather vulnerability poses a significant challenge for marina real estate investments.

Our properties face increased risk due to exposure to natural elements such as storms, hurricanes, and flooding.

These weather events can cause extensive damage, requiring substantial maintenance and repair efforts.

We must carefully assess these risks during the decision-making process to protect our investments.

The changing climate intensifies weather patterns, making marina properties even more susceptible.

Rising sea levels and changing storm intensities demand our attention and adaptation strategies.

Understanding the geographical susceptibility of a marina location is crucial.

Areas regularly experiencing extreme weather events call for more resilient infrastructure.

Strengthening the infrastructure to withstand such events can mitigate financial losses, but also involves higher upfront costs.

Weather-related challenges necessitate a comprehensive insurance plan.

It’s essential to ensure that our coverage adequately protects us from possible weather-related damage.

Securing robust insurance policies can safeguard against potential financial losses.

Adapting our management strategies in response to changing weather patterns plays a critical role in sustainability.

This may include implementing more rigorous maintenance schedules and investing in advanced technologies.

Continuous monitoring and upgrading of property features can also be an effective strategy.

Reinforcing docks and utilizing materials that withstand severe weather conditions are prudent measures.

Proactive efforts are necessary to ensure long-term profitability and stability.

3) Maintenance Expenses

When investing in marina real estate, one of the primary challenges is managing maintenance expenses.

These can be significant due to the harsh environmental conditions marinas face.

Constant exposure to water and weather elements leads to wear and tear, requiring regular upkeep to ensure operations run smoothly.

Our experience shows that costs can escalate with the need for specialized equipment and materials resistant to marine conditions.

Routine tasks such as dock repairs, equipment servicing, and infrastructure upgrades are necessary to maintain safety and functionality.

Unexpected repairs are another consideration, often contributing to fluctuating expenses.

Storm damage and equipment failures can lead to urgent fixes that demand immediate attention and significant resources.

Budgeting for these expenses is critical.

We recommend setting aside a maintenance reserve fund to handle unforeseen events.

This proactive step can help us stay financially prepared and prevent disruptions in operations.

Technology and innovation are playing a growing role in reducing these costs.

Implementing systems for monitoring equipment health and predictive maintenance can help identify issues before they escalate.

It’s essential that we engage skilled professionals familiar with marina operations to carry out maintenance tasks.

Their expertise ensures that repairs and preventive measures are done effectively, preserving the value and safety of the investment.

4) Environmental Regulations

Navigating environmental regulations is a critical challenge when investing in marina real estate.

Regulatory frameworks set by agencies such as the Environmental Protection Agency (EPA) and state and local authorities can significantly influence our investment strategies.

These regulations aim to protect waterways and ecosystems, impacting how we develop and manage marina properties.

Compliance with these rules often requires thorough environmental assessments and adherence to specific guidelines for waste management and pollution control.

This can add complexity and costs to our investment plans.

Staying informed about the evolving regulatory landscape is essential.

New laws or amendments can introduce additional requirements or restrictions.

It’s important for us to work closely with legal experts and environmental consultants to ensure our projects meet all necessary standards.

Investors must also consider potential liabilities associated with past environmental damage.

Prior contamination may require cleanup and remediation efforts, which could be costly.

Conducting diligent environmental due diligence and assessments before acquisition is vital to avoid unforeseen expenses.

We must also balance regulatory compliance with operational efficiency.

Some regulations might limit development opportunities or require adjustments in marina operations.

We need to devise strategies that align with both environmental requirements and business objectives to maintain profitability.

By embracing sustainable practices, we can not only comply with regulations but also enhance our marina’s appeal.

Adopting eco-friendly measures such as renewable energy sources and water conservation can help us manage this challenge while contributing positively to the environment.

5) Insurance Requirements

When investing in marina real estate, understanding the insurance needs is crucial.

Marinas face unique risks and liabilities, making comprehensive insurance coverage essential to protect our investment.

Key insurance types include property coverage, liability insurance, and worker’s compensation.

Each serves an important function, safeguarding different aspects of the marina operation.

Property insurance protects the physical assets like docks, buildings, and equipment against damage from natural disasters or accidents.

These assets are substantial, and any loss could significantly impact profitability.

Liability insurance covers us against legal claims due to accidents or injuries on the premises.

Given the nature of marina activities, the risk of incidents involving boats and people is higher, necessitating adequate protection.

Worker’s compensation insurance is essential if we employ staff.

It ensures coverage for employees in case of job-related injuries, thus protecting us against potential legal claims.

Additionally, business interruption insurance can be worthwhile.

This coverage helps maintain financial stability if the marina cannot operate due to unforeseen disruptions, such as severe weather events.

Obtaining comprehensive insurance requires consulting with providers who specialize in marina-related policies.

They can guide us in choosing the appropriate coverage to meet our specific needs, considering the unique risks associated with marina ownership.

6) Limited Rental Seasons

When investing in marina real estate, one of the main challenges we face is the limited rental seasons.

The demand for marina services often spikes during warm months when boating activities are at their peak.

This seasonality can affect cash flow and profitability.

Our income potential is tied to regional climates.

In colder areas, marinas may operate at reduced capacity or close during off-season months.

This impacts revenue, which can vary significantly from season to season.

To address this, we need to explore ways to generate income year-round.

Offering off-season storage, maintenance services, or community events could help sustain financial health.

Diversifying services can buffer against the effects of seasonal slumps.

Pricing strategies can also play a role in offsetting seasonal fluctuations.

It’s important for us to set competitive pricing during peak times while encouraging off-season usage through discounts or flexible rates.

Understanding local market dynamics helps us make informed decisions.

We must analyze historical data to predict demand patterns and plan accordingly.

Partnering with local businesses could also provide additional opportunities to boost non-seasonal income.

Understanding Marina Real Estate Investments

In marina real estate, prime waterfront locations, market trends, and the unique characteristics of these investments are crucial.

We must consider both the specific attributes of marinas and the dynamic factors influencing this niche market.

Definition and Characteristics

Marina real estate is a specialized segment of the property market situated along bodies of water.

These properties often hold high value due to their location and limited availability.

They include not only the physical docking facilities for boats but also related amenities and infrastructure.

The inherent value of marina real estate lies in its unique setting.

Locations are typically scarce and highly sought after, partly due to the difficulty of replicating waterfront properties.

An additional aspect is the potential for income through dockage fees, boat storage, and ancillary services like repairs and retail.

Marinas are not just investments in land; they encompass a combination of real property with service-oriented business operations.

Market Trends and Dynamics

The market for marina investments is influenced by several key trends.

Economic factors such as interest rates and inflation play significant roles.

We must stay informed about these dynamics, as they directly impact the cost of financing and potential returns.

Demand for marina spaces has seen fluctuations due to varying factors, including recreational boating trends and changing consumer preferences.

Moreover, infrastructure improvements and regulations can alter investment viability.

Key dynamics also include supply chain issues that affect construction and maintenance costs.

With these challenges in mind, successful investors should maintain a watchful eye on the industry to navigate these waters effectively.

Economic and Financial Considerations

Investing in marina real estate requires a careful analysis of its economic and financial dimensions.

Key aspects include the initial investment and sustaining expenses, alongside evaluating the potential return and associated risks.

Initial and Ongoing Costs

The initial costs of acquiring a marina can be significant, encompassing the purchase price, legal fees, and initial renovations.

For existing marinas, upgrading facilities to meet current standards may also require additional capital.

Ongoing expenses like maintenance, staffing, insurance, and taxes should not be overlooked.

Maintenance: Regular upkeep of docking facilities and other amenities is crucial for protecting our investment.

Staffing: Hiring qualified personnel ensures smooth operations and quality service.

These operational costs directly impact the financial feasibility of a marina.

By budgeting accurately and acknowledging unforeseen expenses, we can better manage the financial demands of marina ownership.

Potential ROI and Risks

The potential return on investment (ROI) in marinas hinges on variables such as location, demand, and quality of services offered.

Marinas located in popular areas with high boating activity can command premium fees, enhancing revenue potential.

Income Streams: Rental of berths, lease agreements, and auxiliary services such as fueling and repairs contribute to steady income.

However, we must consider risks such as fluctuating interest rates and economic downturns.

External factors like environmental regulations can also affect profitability.

Analyzing market trends and mitigating risks through diversified offerings can help to optimize returns and secure our investment’s future.

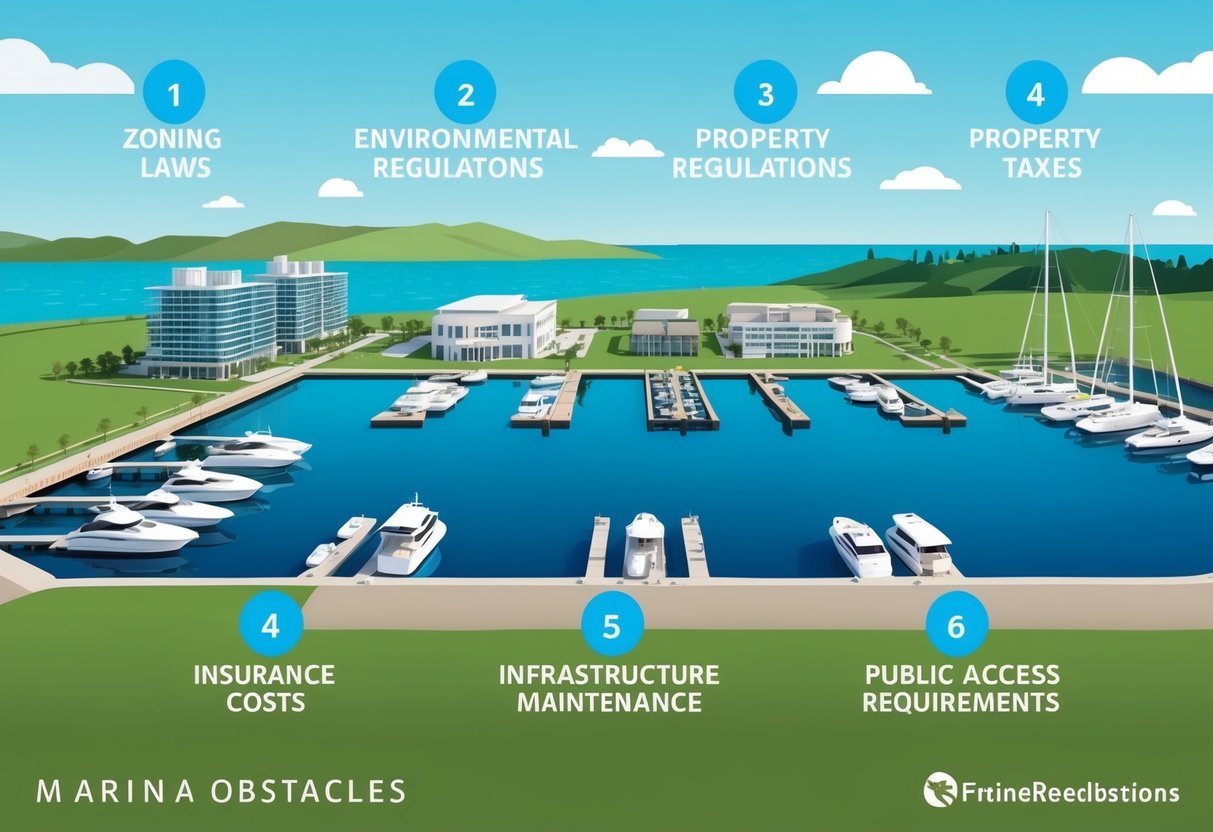

Legal and Regulatory Challenges

When investing in marina real estate, we often navigate complex legal and regulatory landscapes.

Key challenges include understanding zoning laws that dictate allowable uses of waterfront properties, and ensuring environmental compliance to protect delicate ecosystems.

Zoning Laws and Restrictions

Zoning laws can significantly affect marina investments.

These laws establish specific regulations on land use, often dictating what types of activities are permitted.

In marina developments, zoning may restrict commercial activities or impose limitations on expansion.

A beachfront location might attract investors, but stringent local zoning can be a hurdle.

Adhering to these laws is essential to avoid legal battles and potential project delays.

We must thoroughly research local zoning codes and collaborate with legal experts to ensure compliance before purchasing or developing a property.

Environmental Compliance

Maintaining compliance with environmental regulations is another challenge.

The operation and development of marinas must consider impacts on local ecosystems.

For instance, laws may govern water quality, waste management, and the protection of native wildlife.

Engaging environmental consultants early in the project is critical for assessing potential risks and ensuring adherence to legal obligations.

We must prioritize sustainable practices that minimize ecological disruption.

This involves understanding evolving legislation and making proactive decisions to meet all regulatory requirements.

Such diligence not only helps avoid penalties but also supports long-term sustainability of the marina investment.

Frequently Asked Questions

Investing in marina real estate offers unique opportunities and comes with its own set of challenges.

Our exploration will address core risks, cap rate comparisons, key evaluation factors, insights from the 2024 Marina Investment Report, recent industry evolution, and considerations for potential investments.

What are the primary risks associated with investing in marina real estate?

Investors face several risks, including environmental regulations, weather vulnerability, and fluctuating market conditions.

Marinas are subject to severe weather events that can lead to significant repair costs.

Compliance with strict environmental laws can also impact operational costs and profitability.

How do cap rates in the marina real estate market compare to other investment properties as of 2024?

Marina real estate often presents different cap rate dynamics compared to other property types.

Typically, higher cap rates reflect the sector’s unique challenges, such as maintenance expenses and insurance requirements, requiring careful strategy to maximize returns.

Can you identify key factors to evaluate before making a marina real estate investment?

Thorough market analysis is essential.

Consider location demand, operational costs, and zoning restrictions.

Investors should also investigate leasing potential, dock appeal, and financial performance history to ensure a viable investment opportunity.

What insights does the 2024 Marina Investment Report offer regarding current investment prospects?

The 2024 Marina Investment Report highlights increasing interest as the market cap grows.

It emphasizes strategic investments driven by rising demand, identifying high-potential regions and forecasting continued development in waterfront properties.

How has the marina industry evolved recently, and what impact does this have on investments?

Recent industry evolution is marked by increased demand and heightened interest post-pandemic.

This growth affects marina scarcity and attracts more investors, leading to competitive pricing.

Our strategy should focus on navigating these developments to seize emerging opportunities.

What considerations should be made when looking at marinas for sale as potential investment opportunities?

Key considerations include evaluating high entry costs, understanding maintenance duties, and ensuring insurance compliance.

It’s vital to conduct detailed due diligence.

Focus on physical inspections and financial audits to secure investments that align with our strategic goals.