In the dynamic world of real estate investing, agriculture-adjacent properties present an intriguing opportunity.

This niche area combines the stability of land ownership with the potential growth linked to the agricultural sector.

Our exploration into agriculture-adjacent real estate seeks to uncover strategic insights that can enhance investment portfolios. By considering various factors such as land value appreciation, market trends, and economic influences, we can develop informed strategies that align with individual investment goals.

1) Assess Local Market Trends

When investing in agriculture-adjacent real estate, we must carefully examine local market trends.

These trends help us forecast demand and identify emerging opportunities that could enhance our investments.

We should begin by analyzing historical data on property values and sales in the area.

Changes in land prices can provide insight into market movement and help us anticipate future growth.

Demographic shifts also play a critical role.

Understanding population growth, age distribution, and migration patterns will enable us to adapt our strategies to align with the evolving needs and preferences of the local community.

We should also focus on economic indicators such as employment rates and the presence of agricultural businesses.

These factors can significantly influence property values and demand in agriculture-adjacent areas.

Paying attention to governmental policies and zoning regulations is another important step.

These policies affect what can be developed or modified on the land, directly impacting potential returns on our investments.

By closely observing infrastructure developments, we can gauge the potential for increased connectivity and accessibility, which often lead to appreciation in property values.

Staying informed about environmental factors, like water availability and climate conditions, helps us assess the sustainability and long-term viability of our investments.

Finally, we benefit from engaging with local stakeholders, including farmers, real estate agents, and community leaders.

Their insights offer a nuanced perspective on the area’s challenges and opportunities, informing our investment decisions.

2) Explore Agritourism Opportunities

Agritourism presents a unique chance for us to enhance the value of agricultural real estate.

By blending agriculture with recreational or educational activities, we can diversify revenue streams and foster community engagement.

This approach not only attracts tourists seeking rural experiences but also provides a buffer against the volatile nature of traditional farming income.

We should consider developing features like farm stays and pick-your-own produce ventures.

These can transform a simple piece of farmland into an inviting destination, appealing to those eager to connect with nature and the origins of their food.

Additionally, farm tours and educational programs can offer insights into sustainable practices, engaging and educating visitors.

Our investment strategy can benefit from leveraging existing agricultural assets to create memorable experiences.

Converting barns into event spaces for weddings or workshops is one idea.

Providing guided tours or animal interaction opportunities adds another layer to the attraction.

The potential to revitalize local economies through agritourism is significant.

It often supports other businesses in the area, such as local artisans and restaurants, creating a thriving economic ecosystem.

This added value helps protect against market fluctuations and ensures a steady influx of visitors.

We should also consider real estate investments in regions where land is not only fertile but also accessible to major urban areas.

Proximity to large cities can vastly increase the potential visitor base, making the return on investment more predictable and substantial.

When we evaluate prospective properties, it’s crucial to assess both their agricultural potential and their appeal to tourists.

Understanding local culture and history can inspire unique, authentic experiences that draw visitors to a particular location, ensuring sustained interest and financial success.

3) Invest in Farmland

When we consider agriculture-adjacent real estate investments, farmland stands out as a compelling opportunity.

With farmland, we can directly purchase cropland or pastureland and lease it to farmers or ranchers.

This approach often requires significant initial capital, as the purchase price of usable land can be substantial.

Farmland offers long-term stability with a moderate but consistent return.

Leasing out farmland ensures a steady income, either through fixed rental agreements or profit-sharing arrangements.

This investment can also benefit from land value appreciation over time, adding to our asset’s potential return.

While farmland income can be stable, it’s important to consider potential risks such as weather unpredictability and market fluctuations.

These factors can lead to income variability.

Diversifying our investment portfolio with different types of crops or regions can help mitigate some of these risks.

There are various methods to engage with farmland investment.

For those unable to directly purchase land, farmland REITs or investment platforms provide the option to buy shares.

These alternatives involve lower entry costs and offer more liquidity compared to direct land ownership.

Regardless of the approach we choose, understanding our investment horizon and financial goals is key.

Farmland investments are typically suited for those interested in a long-term commitment.

This helps us maximize potential gains through both rental income and land appreciation.

Investing in farmland can be a strategic move in our agriculture-adjacent real estate strategy.

By carefully considering our options and balancing risks, we can capitalize on the opportunities this sector presents while contributing to the agricultural economy.

4) Consider Value-Added Enterprises

When investing in agriculture-adjacent real estate, incorporating value-added enterprises can significantly enhance the property’s potential and profitability.

By focusing on projects that elevate the value of raw agricultural products, we can create opportunities that benefit both the property and the broader community.

For instance, establishing facilities for processing agricultural goods directly on the property adds tangible value.

This could include operations like fruit canning, dairy processing, or even turning wheat into flour.

These value-added activities help increase profitability and improve local economic resilience.

Another approach is to engage in agritourism, transforming parts of the property into visitor attractions such as farm-to-table restaurants, pick-your-own orchards, or educational farms.

Such activities not only generate additional income streams but also foster a deeper connection between urban and rural areas.

Incorporating renewable energy projects is another value-added strategy we can explore.

Solar panels, wind turbines, or biomass operations can provide energy solutions that reduce costs and support sustainable farming practices.

These projects might also attract environmentally conscious investors or tenants.

Creating artisanal or specialty products tied to the land’s output can be another avenue for value addition.

For example, establishing a local brand of organic jams or handcrafted cheeses can appeal to niche markets, further enhancing the property’s appeal and value.

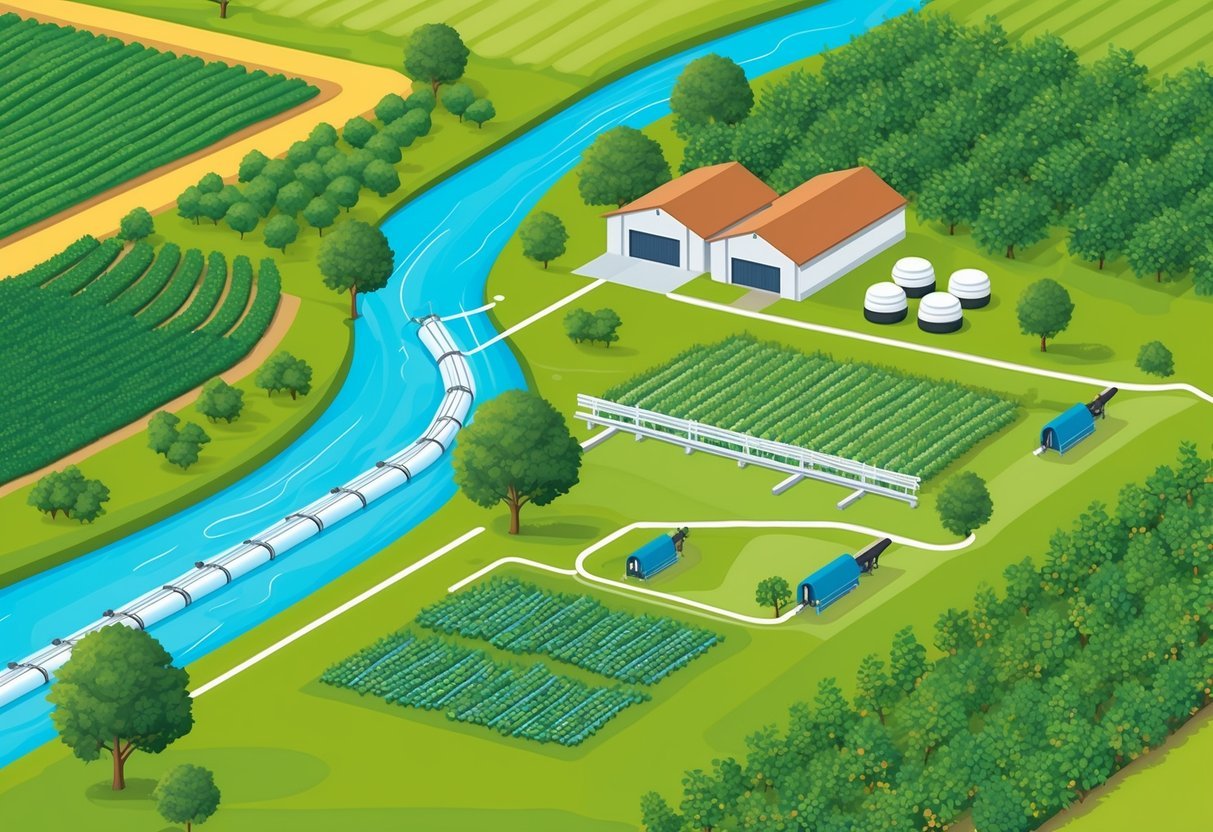

5) Focus on Water Rights

When investing in agriculture-adjacent real estate, water rights are a crucial aspect to consider.

They determine who can use water from a particular source and how much they can use.

In areas facing water scarcity, securing these rights can significantly influence the value of agricultural land.

Understanding the distinctions between riparian and prior appropriation rights is essential.

Riparian rights pertain to properties adjacent to a water source, while prior appropriation rights are allocated based on a first-come, first-served principle.

This knowledge allows us to navigate regional variations and ensure that our investments remain viable and sustainable.

Due diligence is paramount in evaluating water rights attached to prospective properties.

We should review legal documents and consult with water rights experts to understand any limitations or obligations.

It’s essential to know how existing agreements might affect future agricultural possibilities.

Monitoring future trends is also vital.

Climate change and technological developments are reshaping how water resources are managed.

Keeping abreast of these changes ensures that our investments remain adaptable and forward-thinking, considering both short-term needs and long-term sustainability.

Strategic planning for water management is essential for maximizing returns.

By aligning with local regulations and investing in efficient irrigation systems and conservation practices, we can improve water usage efficiency.

Responsible stewardship of water rights not only benefits the environment but also enhances the value and productivity of our investments.

6) Evaluate Renewable Energy Potential

In agriculture-adjacent real estate, we should explore the potential for renewable energy integration.

This can enhance the value of our investment and help contribute to sustainability goals.

Properties with access to abundant sunlight or strong wind currents could be ideal candidates for solar panels or wind turbines.

By assessing the energy output potential, we can identify opportunities to reduce operational costs.

Utilizing renewable energy on-site not only complements agricultural practices but also offers independence from fluctuating energy prices.

This approach reduces emissions and can make our properties more attractive to eco-conscious tenants or buyers.

When evaluating renewable energy potential, it’s important to consider the infrastructure required.

We must factor in the initial investment for equipment and installation.

Knowing the available incentives or tax benefits can significantly influence our decision.

Collaborating with experts in renewable energy can provide valuable insights and help us design efficient systems.

By doing so, we ensure that the renewable energy solutions implemented are tailored to the specific conditions of the property.

Thorough evaluation and planning can maximize the energy benefits, reinforcing the economic and environmental advantages.

Understanding Agriculture-Adjacent Real Estate

Agriculture-adjacent real estate involves investing in properties connected to farming and agriculture without directly owning a farm.

This niche market is gaining recognition for its potential to yield profitable returns.

By examining its definition and historical trends, we can better anticipate what to expect in the future.

Definition and Scope

Agriculture-adjacent real estate consists of properties that support or enhance agricultural activities indirectly.

These can include facilities such as warehouses, distribution centers, and storage units that are vital for managing farm products. Real Estate Investment Trusts (REITs) often play a significant role by owning and operating such properties.

These types of investments offer an alternative entry point for those interested in the agriculture sector without being directly involved in farming operations.

By leveraging this broader scope, we can diversify risks and tap into the lucrative agriculture marketplace.

Historical Trends and Future Outlook

Historically, the demand for agriculture-adjacent properties has been tied to trends in both the agriculture and logistics industries.

As global food demand increases, so does the need for infrastructure that supports food distribution and storage.

This trend highlights the value these properties can bring to an investment portfolio.

Looking ahead, technological advancements and shifts in global supply chains are likely to influence the growth potential of this real estate sector.

We should keep an eye on how innovations in agriculture and logistics drive new opportunities for agriculture-adjacent investments.

These trends are poised to ensure consistent growth and stability in this investment area.

Evaluating Market Conditions

Investing in agriculture-adjacent real estate requires a careful analysis of market trends and geographical factors.

Understanding economic indicators and the specific characteristics of a location are crucial.

Economic Indicators

We should begin by examining interest rates, as they directly impact financing costs.

Low rates may indicate a good time to invest, while higher rates can signify increased borrowing costs.

Inflation rates also matter; rising inflation may increase land value but also the cost of development.

Supply and demand dynamics play a key role in evaluating market conditions.

An abundant supply of agricultural products with increasing demand can enhance property value.

Government policies affecting agriculture, such as subsidies or restrictions, must also be considered.

Geographic Considerations

It’s important to analyze variables like soil quality, which affects the agricultural potential of the land.

Areas with rich, fertile soil can offer better returns on investments related to farming activities.

Climate conditions also matter significantly, influencing both crop viability and long-term sustainability.

Access to transportation infrastructure is another geographical factor.

Properties near highways or rail lines may provide easier access to markets, increasing their value.

We should also evaluate water availability, as a reliable water source can boost agricultural productivity and, by extension, real estate value.

Frequently Asked Questions

Investing in agriculture-adjacent real estate opens a range of opportunities from utilizing technology to exploiting local market trends.

Our focus is on farmland platforms, REIT performance, investment strategies, expected returns, and the influence of agricultural tech.

What are the top platforms for investing in farmland?

Various platforms such as AcreTrader allow us to buy shares in farms, making it easier to enter the agriculture real estate market.

These platforms manage investments and facilitate profit distributions, providing a streamlined process for both novice and experienced investors.

How do farmland REITs perform as an investment option?

Farmland Real Estate Investment Trusts (REITs) offer a viable option for diversifying our portfolio, with the potential for steady returns.

They hold a significant portion of America’s farmland, providing access to profits from agricultural production activities without owning a farm directly.

What are proven strategies for investing in agriculture-related real estate?

We focus on assessing local market trends and exploring agritourism opportunities.

Additionally, investments in value-added enterprises and considerations regarding water rights can maximize our involvement in agriculture-related real estate and increase property value.

What are the expected returns for investing in farmland?

Expected returns can vary based on location, crop types, and market conditions, but they generally offer long-term growth potential.

While some fluctuations may occur, farmland often provides a stable income stream, especially with a focus on scalable and sustainable farming practices.

How can individual investors participate in agricultural real estate investment opportunities?

Individual investors can engage through direct purchase, crowdfunding platforms, or participation in REITs.

These options provide varying levels of involvement and capital requirements, making it easier for us to find a suitable entry point into agricultural real estate.

What is the role of agricultural technology in enhancing real estate investment in farming?

Agricultural technology plays a crucial role in increasing yields and operational efficiency, which can enhance property value.

Our investments benefit from innovations like precision farming.

This technology optimizes resources and improves productivity, contributing to healthier long-term investment returns.