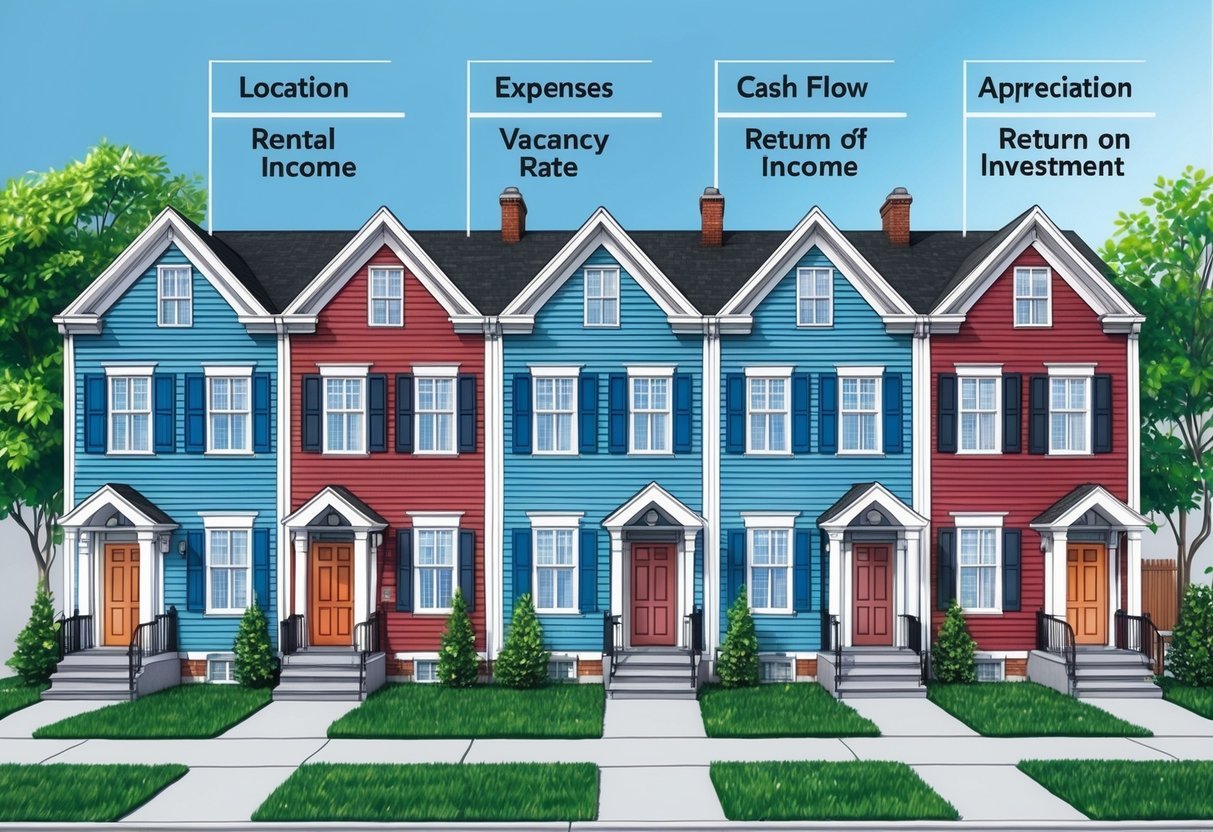

When you step into the realm of rental property investment, you need to understand the crucial metrics that influence an investment’s success.

The real estate market can be intricate, filled with numerous factors that impact the overall profitability of a property.

These metrics offer valuable insights into various aspects such as financing, property conditions, and potential returns.

By focusing on these, you can better assess the market and make strategic choices that align with your investment goals.

1) Occupancy Rates

Occupancy rates are a crucial metric in evaluating rental properties.

They measure the percentage of rented units compared to the total available units within a property.

When the occupancy rate is high, it indicates strong demand and suggests that the property is attractive to potential tenants.

This can be a signal of stability and reliable income for you as an investor.

Monitoring occupancy rates helps you understand how a property is performing in the current market environment.

A consistent or improving rate implies that the property remains competitive and appealing.

You should analyze local market trends to assess whether changes in occupancy are related to specific property features or external market conditions.

By staying informed about the occupancy rate, you can make data-driven decisions regarding pricing and marketing strategies.

For instance, if you notice a decline in occupancy, it might be necessary to reassess rental pricing or explore enhancements to the property to increase its appeal.

Predicting future income can be more accurate when you closely monitor these rates.

Projections become more reliable with historical data on occupancy trends.

This allows you to anticipate potential adjustments in cash flow, facilitating better financial planning.

Additionally, maintaining high occupancy rates can enhance tenant retention and satisfaction.

When tenants are satisfied, they are more likely to renew leases, which reduces turnover costs.

Understanding occupancy dynamics assists in creating a stable and prosperous rental property investment.

2) Cash Flow Analysis

When evaluating rental properties, cash flow analysis is essential for understanding financial viability.

At its core, cash flow is the net amount of money moving in and out of a property.

This involves considering rental income against expenses such as mortgage payments, maintenance costs, and taxes.

Ensuring positive cash flow means the property generates more income than it costs to operate.

You prioritize examining cash flow to ensure that the property provides a reliable source of income.

Positive cash flow signifies that after all expenses are paid, there’s extra income left.

This surplus can be reinvested or used for other purposes, enhancing the investment’s overall value.

To accurately assess cash flow, you need detailed records of both income and expenses.

Rental agreements provide insights into expected income, but analyzing historical data gives you a more realistic picture.

Understanding expenses involves accounting for fixed costs, such as property tax, and variable costs like maintenance.

By incorporating projected expenses and evaluating them against potential revenue, you can make informed decisions.

Additionally, cash flow analysis helps in identifying properties that might require cost adjustments or rent increases to remain profitable.

Keeping an eye on market trends and location-specific factors further refines your cash flow predictions.

Robust cash flow analysis aids in determining the long-term financial health of rental properties.

It helps you avoid investments that may seem attractive at first but fail to maintain income over time.

By focusing on cash flow, you ensure that each property not only covers its costs but also contributes to your financial goals.

3) Location Quality

When evaluating rental properties, location is paramount.

You need to consider the neighborhood’s reputation, the quality of local schools, and nearby amenities like parks and shopping centers.

These factors can significantly influence tenant attraction and retention, impacting your property’s long-term value.

Proximity to public transportation is another critical aspect.

Easy access to buses or trains can make a location more appealing to potential tenants, particularly in metropolitan areas where commuting is common.

Safety is also crucial.

Crime rates can deter potential tenants and affect rental income stability.

You can benefit from researching local crime statistics to ensure the property is in a safe and secure area.

It’s essential to analyze market trends in the area.

Are there signs of growth, like new developments or businesses moving in? These indicators can suggest an appreciation in property values, promising a solid return on investment for you.

Infrastructure plays a key role too.

Good roads, reliable utilities, and access to internet and cable services make a location more attractive.

You should always assess these factors before making a purchasing decision.

Lastly, you should examine the local job market.

A strong job market can attract more tenants and keep vacancy rates low.

Cities or towns with diverse employment opportunities often offer more stable rental prospects.

4) Property Condition

When you consider a rental property, assessing the condition is crucial.

It goes beyond the surface-level appeal and dives into the structural soundness, systems like HVAC and plumbing, and potential pest issues.

A thorough inspection can reveal hidden problems, ensuring your investment remains solid and reliable.

You need to pay close attention to the property’s age and the recent renovations, if any.

Older properties may have charm, but they often require more maintenance.

Recent upgrades can reduce future repair costs, adding value to your investment.

Inspecting the roof, foundation, and walls is essential.

These are costly elements to repair, so you must ensure they are in good shape.

Evidence of water damage or structural shifts might signal underlying issues needing immediate attention.

Checking the functionality of the heating, cooling, and electrical systems is another priority.

Operational systems prevent unexpected expenses and tenant dissatisfaction.

We recommend obtaining a professional evaluation to verify their efficiency.

The property’s exterior also influences its condition.

A well-maintained yard and sound exterior walls enhance curb appeal and keep repair costs down.

Keeping an eye on these aspects forms part of a comprehensive evaluation strategy.

5) Tenant Demographics

Understanding tenant demographics is crucial when evaluating rental properties.

It’s essential to analyze the population in the area to determine if it aligns with the kind of tenants you aim to attract.

For instance, a neighborhood with a higher percentage of young professionals will appeal differently compared to one predominantly inhabited by families or retirees.

You should study the age distribution and lifestyle preferences within the community.

A property in a bustling urban center may attract college students and young workers, making smaller apartments more desirable.

Conversely, suburban areas might draw families that seek larger homes with multiple bedrooms.

Comprehending income levels and employment statistics helps you gauge the financial status of potential tenants.

Higher average incomes suggest a capacity for paying higher rents, while a robust job market may indicate stability in rental demand.

Identifying the dominant industries can further guide you in understanding where prospective tenants might work.

Exploring cultural and social dynamics allows you to cater to tenant preferences more effectively.

Areas with diverse populations might have distinct needs and expectations regarding housing, from layout to amenities.

This understanding can help tailor your rental offerings to suit specific tenant groups.

By profiling tenant demographics, you direct your investment strategy towards properties that suit your target market, ensuring better occupancy rates and tenant satisfaction.

Keeping an eye on demographic shifts also prepares you to adjust your approach as community profiles evolve.

6) Market Trends

When evaluating rental properties, market trends play a significant role in decision-making.

You must understand how the real estate market is performing locally and nationally.

This includes keeping an eye on housing prices, rental rates, and vacancy rates.

Trends in interest rates are also essential.

Interest rate changes can affect your financing options and the overall cost of acquiring properties.

Monitoring these rates helps you make informed decisions.

Population growth or decline in an area can indicate future demand for rental properties.

Seeing an influx of new residents often suggests a potential for increased rental demand, making an area more attractive for investment.

Employment trends provide insights into the economy’s health in a particular region.

A strong job market can lead to higher demand for housing, as more people move in for work.

This can positively influence rental prices and occupancy rates.

You should also consider construction trends, which can affect supply and demand.

A high rate of new construction might lead to increased competition, impacting rental rates and property values.

Seasonal trends in the real estate market can dictate the best times for buying properties.

For example, certain times of the year may have more listings or potentially better deals, depending on the region.

Emerging neighborhoods can offer unique investment opportunities.

Identifying areas on the brink of growth allows you to invest before prices rise, maximizing your returns.

To do so, you must stay informed about city development plans and infrastructure projects.

7) ROI Calculations

When buying rental properties, understanding the Return on Investment (ROI) is crucial for assessing potential profitability.

ROI provides insights into how well an investment is performing.

To start, you calculate ROI using a simple formula: ROI equals Net Profit divided by Purchase Price.

The net profit represents the difference between the resale price and the purchase price.

It’s essential to include all costs incurred, such as repairs, improvements, and operational expenses, when calculating net profit.

This ensures an accurate reflection of the investment’s returns.

Properly accounting for these expenses allows you to determine the true profitability.

Annual ROI is another valuable measure, which divides annual returns by the total investment cost.

This method helps evaluate the efficiency of your investments over a specific timeframe.

When calculating annual ROI, consistent monitoring helps you spot trends and improve profitability.

Some investors prefer calculating ROI without mortgage considerations, known as the cap rate.

The cap rate focuses solely on a property’s unleveraged return, giving insight into its intrinsic performance.

This can be useful when comparing properties.

Overall, industry-specific factors, like location and property type, heavily influence ROI.

Different properties can yield vastly different returns based on their location and market dynamics.

Understanding these influences helps you step toward acquiring profitable rental properties.

Understanding Rental Income

Understanding rental income is crucial for assessing any property’s profitability.

Let’s explore how gross rental income provides basic insights, while net operating income delves into the actual earnings after accounting for necessary expenses.

Gross Rental Income

Gross rental income represents the total amount received from tenants before any deductions.

It’s important to consider various factors that can impact this figure, such as rental rates, occupancy rates, and lease terms.

High occupancy rates result in stable cash flows, while understanding market rent helps you set competitive pricing.

By listing monthly rent, annual rent, and any potential additional sources of income, such as fees for parking or amenities, you can better gauge the property’s income potential.

This baseline figure is vital to evaluate cash flow projections and compare various property investments.

Net Operating Income

Net Operating Income (NOI) provides a more comprehensive view by considering expenses.

It involves subtracting operating expenses from the gross rental income.

Operating expenses include property taxes, insurance, and management fees.

NOI helps us assess a property’s operational efficiency and is a key metric when considering financing options.

Higher NOI usually indicates better financial performance, which can enhance investment appeal.

To gain a clear understanding of the property’s profitability, you must maintain accurate records of both fixed and variable costs.

Evaluating Property Appreciation

Evaluating property appreciation involves examining historical market trends and analyzing relevant economic indicators.

These factors collectively guide us in predicting potential growth and increases in property value.

Historical Market Trends

Understanding historical market trends allows us to grasp how property values have fluctuated over time.

A thorough examination of past data can reveal patterns, such as the impact of economic cycles on property prices.

We should analyze long-term price trends to identify steady growth areas.

Historical appreciation rates offer insight into future valuations.

Property types, locations, and the broader economic context all play roles in these trends.

It’s essential to consider periods of volatility, as these might suggest potential risks or downturns.

By examining market history, we gain a comprehensive view of what to expect in future performance.

Economic Indicators

Economic indicators significantly influence real estate appreciation and help us make informed decisions.

Indicators like GDP growth, employment rates, and inflation can predict changes in property values.

Low unemployment and strong GDP growth often correlate with rising property values, as they indicate a robust economy.

Conversely, high inflation may erode purchasing power, potentially affecting real estate investment.

Interest rates also shape market dynamics.

Lower rates can spur demand, leading to appreciation, while higher rates might cool it down.

We should monitor these indicators to anticipate shifts in property appreciation potential, ensuring strategic investment choices.

Analyzing Cash Flow Potential

When evaluating rental properties, a thorough analysis of cash flow potential is essential.

This involves calculating both monthly and annual projections to ensure profitability and sustainability.

Monthly Cash Flow

Monthly cash flow is a crucial metric for rental property investments.

It starts by estimating the total rental income.

We then deduct all operating expenses, including property management, maintenance, taxes, and insurance.

Factoring in mortgage payments, if applicable, is also necessary to ascertain net cash flow.

This analysis helps determine if a property will generate positive cash flow or require more financing.

Positive cash flow indicates financial health, ensuring that income exceeds expenses.

It’s also vital to account for any potential vacancies.

Unexpected vacancies can significantly impact cash flow, making savvy planning indispensable.

Annual Cash Flow Projections

Annual cash flow projections provide a broader view of a property’s profitability over time.

These projections start with monthly cash flow multiplied by twelve and adjusted for expected changes.

Things like seasonal income fluctuations, property value appreciation, and anticipated market trends play a significant role.

Analyzing annual projections allows us to identify long-term prospects and risks.

We consider historical data and market research, creating a comprehensive understanding of potential returns.

Capital improvements and operating costs are vital factors that affect these projections, possibly altering net cash flow over the years ahead.

With well-analyzed annual projections, we gain insights into potential investments, avoiding landlords unpleasant surprises.

Frequently Asked Questions

In our analysis of rental properties, it’s crucial to focus on profitability, utilize key performance metrics, and understand financial indicators.

These components guide our decisions and help ensure successful investments.

How do you calculate the profitability of a rental property investment?

We calculate profitability by assessing rental income and comparing it with expenses such as maintenance, taxes, and insurance.

Cash flow, which is the difference between income and expenses, is also a vital measure.

Positive cash flow indicates a profitable investment.

What are the common metrics to assess the performance of real estate investments?

Commonly used metrics include metrics like cash flow analysis, return on investment (ROI), and net operating income (NOI).

These tools help us evaluate potential returns and detect any financial weaknesses in the investment.

How does the capitalization rate (cap rate) compare to the yield in real estate evaluation?

The cap rate provides a quick snapshot of an investment’s return, based on the property’s net income relative to its price.

Yield, on the other hand, considers the income generated compared to the initial investment, offering a broader understanding.

What are the main financial indicators to consider in commercial real estate analysis?

For commercial properties, indicators such as gross rent multiplier (GRM), internal rate of return (IRR), and debt service coverage ratio (DSCR) are essential.

They help us assess the property’s earning potential and financial health.

What is the significance of the 2% rule in property investment?

The 2% rule suggests the monthly rental income should be at least 2% of the purchase price.

This guideline helps us determine whether a property might generate satisfactory cash flow.

Can you explain the 4 3 2 1 rule in the context of real estate investing?

The 4 3 2 1 rule helps us structure a real estate portfolio.

It suggests gradual investments: four single-family homes, three duplexes, two triplexes, and one fourplex.

This strategy aims to spread risk and optimize returns.