Investing in land can offer significant opportunities, but it requires careful analysis to ensure a profitable venture.

Understanding the key metrics involved in evaluating land is crucial for making informed decisions that align with investment goals.

Identifying and assessing these critical metrics can help us mitigate risks and maximize our returns.

By focusing on the right metrics, we empower ourselves to make strategic investments in real estate. This approach allows us to uncover the true potential of a property, beyond its surface value.

As we navigate the complexities of land investment, these metrics serve as our guide in achieving financial success.

1) Location Analysis

Location analysis is a critical step in assessing any land investment.

We begin by examining the surrounding area’s economic factors, ensuring our choice supports long-term appreciation.

Market trends, employment rates, and population growth all play vital roles in evaluating potential.

We consider the accessibility of the location.

Proximity to major highways, public transportation, and amenities like schools and shopping centers can significantly boost land value.

These elements enhance convenience, attracting residents and businesses.

Environmental factors deserve attention too.

We need to check for any geographical or environmental risks, such as flood zones or earthquake-prone areas.

Evaluating the natural features of the area helps us determine potential land uses and any possible restrictions.

We must understand zoning laws and regulations.

This influences the potential types of developments allowed on the land, impacting its value.

It’s essential to align the land’s characteristics with zoning requirements to maximize investment opportunities.

Another key factor is the socio-economic makeup of the area.

We examine the area’s demographics to predict future demand.

Understanding the age distribution, income levels, and education of the local population helps us tailor our investment strategy.

Land use patterns provide valuable insights.

We identify existing developments and their success rates in the area.

This helps us identify what types of projects are likely to thrive, shaping our buying decision.

We also evaluate potential competition in the vicinity.

Market saturation can affect the land’s value, so analyzing existing businesses and developments nearby is crucial.

This way, we position ourselves strategically in the market.

2) Zoning Restrictions

When considering land for investment, understanding zoning restrictions is crucial.

These regulations, imposed by local governments, dictate how land can be used within specific areas.

They impact what can be built and how properties can be developed.

First, we must identify the land’s zoning classification.

This information is available through the local city or county zoning office.

It can also often be accessed through their websites.

Knowing this classification helps us gauge whether our intended use aligns with existing rules.

Next, let’s assess any restrictions that may affect our investment plans.

For instance, zoning laws might limit building heights, specify the types of structures allowed, or impose aesthetic guidelines.

These details can significantly impact our project’s feasibility and cost.

We should also be aware of any potential for zoning amendments or variances.

It could be possible to request changes if the current zoning doesn’t support our plans.

Working with local authorities and understanding the process for these changes is vital.

Additionally, it’s important to consider future zoning changes in the area.

Local development plans or proposed zoning revisions can influence the long-term value of our investment.

Engaging with community plans and discussions can offer insight into potential shifts.

3) Soil Quality

When evaluating land for investment, soil quality is a crucial metric to consider.

The productivity of the land is closely tied to the characteristics of the soil.

High-quality soil can boost agricultural yields and ensure long-term profitability.

We must examine various soil health indicators, such as organic matter content, which contributes to nutrient availability and retains moisture, supporting robust plant growth.

Soil pH levels are equally important, as they influence nutrient absorption by plants.

An ideal pH balances soil fertility, ensuring optimum conditions for diverse crops.

Observing the soil’s physical properties, like texture and drainage, helps us understand its impact on crop productivity.

Proper soil drainage prevents waterlogging and maintains aeration, which is vital for root health.

Biological components, including the presence of beneficial microorganisms, are also essential.

These organisms enhance nutrient cycling and improve soil structure.

Healthy microbial activity is often assessed through soil respiration rates, providing insight into biological health.

Assessing potential soil erosion risks is another key factor.

Erosion can lead to significant losses in topsoil, reducing fertility and diminishing land value.

Evaluating land for erosion vulnerability ensures sustained agricultural performance.

Utilizing soil maps can aid strategic planning by providing existing data on soil types and their suitability for various uses.

These maps offer a comprehensive overview of the land’s potential and guide us in making informed decisions.

4) Land Size & Shape

When investing in land, analyzing the size and shape of a property is critical.

The dimensions not only affect the potential uses but also the overall value of the land.

A rectangular or square piece of land typically offers more usability, making it easier to subdivide or develop.

It provides flexibility for various projects.

Irregularly shaped lots might present challenges.

For instance, they may have limitations when it comes to building structures or dividing the land for multiple uses.

We should consider how the shape can affect accessibility and functionality, which are important factors for future development.

The size of the land impacts its market value and potential return on investment.

Larger plots often provide more opportunities, such as agricultural uses, recreational spaces, or residential developments.

Meanwhile, smaller parcels might be more suitable for niche purposes or hold potential for compact developments.

Assessing how the land’s size aligns with local zoning laws is essential.

Regulations can dictate the types of buildings permitted and any required setbacks from property lines.

Understanding these rules helps us evaluate what can be achieved on the land.

Visualizing the landscape can help us better understand how the size and shape influence other aspects like soil quality or drainage.

Each of these factors might affect construction or agricultural potentials.

We need to ensure the land’s physical characteristics align with our investment objectives.

5) Topography & Drainage

When assessing potential land investments, examining the topography plays a crucial role.

The land’s contours affect not only the aesthetic appeal but also its usability.

Flat or gently rolling terrain might be more suitable for various developments, whereas steeply sloped areas can pose challenges and might involve increased construction costs.

Drainage is equally important when evaluating a property.

Proper drainage ensures that water is effectively managed, reducing the risk of flooding and soil erosion.

Poor drainage can lead to water pooling, which may impact foundations and overall land stability.

This is an important factor to consider during the initial site inspection.

Land with natural drainage features might require less intervention.

Yet, any existing issues need our attention as they could lead to significant maintenance costs in the future.

Analyzing topography and drainage together provides insights into the suitability of land for specific purposes, whether residential, agricultural, or commercial.

We must also consider local regulations related to drainage and land use.

Some areas might have stringent guidelines that dictate how drainage must be managed, especially in places prone to flooding.

Understanding these regulations can help us avoid potential legal issues and ensure the land meets all local requirements.

Finally, engaging with experts like surveyors or engineers for a comprehensive evaluation can be beneficial.

They can provide detailed insights into the topographical features and drainage characteristics, giving us a clearer picture of any future developments or investments.

6) Accessibility

When analyzing land for investment, accessibility is a key factor we must consider.

Accessibility pertains to how easily a property can be reached by transportation or individuals.

A well-located plot with easy access to roads, highways, and public transportation options can greatly increase its desirability and value.

We should evaluate the proximity of the land to essential amenities such as schools, hospitals, and markets.

Easy access to these facilities not only makes the location attractive for potential buyers but also raises the living standards for future residents.

This can lead to higher market appreciation over time.

It’s also crucial for us to consider future development plans in the area.

If there are upcoming infrastructure projects such as new roads or transit lines, they could enhance the accessibility of the land significantly.

This potential for increased connectivity can make an investment more appealing.

We also need to conduct a thorough analysis of any existing geographical barriers that might limit access, such as rivers or railway lines.

Understanding these challenges helps in assessing the true accessibility of the investment land, enabling us to make informed decisions.

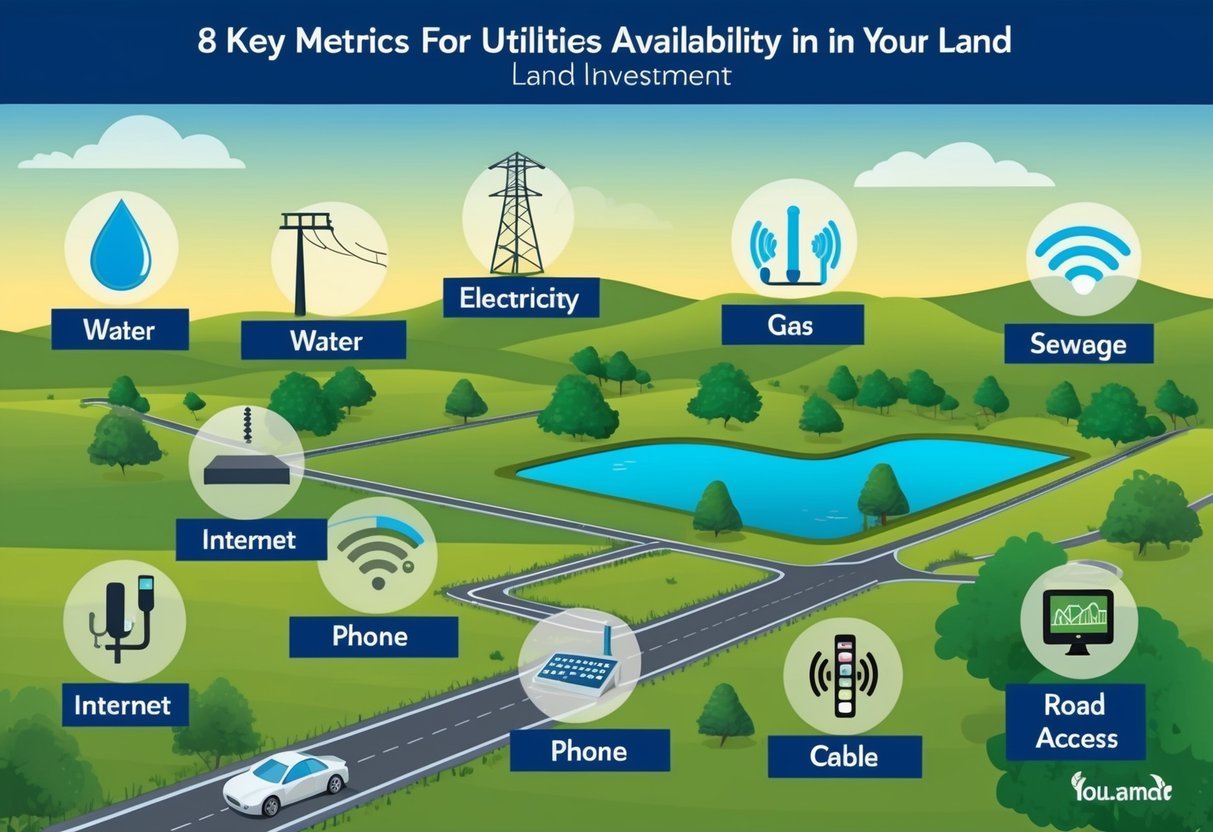

7) Utilities Availability

When considering land for investment, we must assess the availability of essential utilities.

Access to water, electricity, gas, and sewage systems is crucial.

Without these, development opportunities might be limited, affecting potential returns.

We should verify the existing infrastructure and determine the costs associated with connecting to these utilities if they are not readily available.

Not all properties have the same level of access, especially those in remote areas.

We should investigate the feasibility of alternative solutions, like wells or solar panels.

Utility providers can offer insights into future expansions that could impact the land’s value.

Proper due diligence ensures we avoid unexpected expenses and delays.

It’s important to factor in the time it might take for utilities to be connected, as this can delay development plans.

By evaluating utilities availability thoroughly, we can make informed decisions that optimize our investment strategy.

8) Price & Market Trends

When investing in land, assessing price and market trends is crucial.

We need to consider historical data to understand how property values have changed over time in a given location.

This helps in projecting future price movements and potential returns.

By examining economic indicators, we can identify market cycles.

Inflation rates, interest rates, and employment levels can provide insights into the broader economy and its influence on real estate.

Demographic shifts also play a significant role.

Changes in population density, urbanization trends, and migration patterns can affect property demand.

We should analyze these factors to anticipate shifts in the market that could impact our investment.

Additionally, government policies such as zoning laws, tax incentives, and infrastructure development can greatly influence land prices.

Keeping abreast of these policies helps in making informed decisions.

Local amenities, like schools and public transport, significantly impact land values.

An area with well-developed infrastructure can attract more buyers and renters, boosting demand and price stability.

We must evaluate the potential for growth and access to essential services.

Real estate technology and data platforms offer tools to analyze market trends.

Utilizing these resources can provide real-time insights into market dynamics.

We can use this information to compare land prices, identify trends, and make data-driven decisions.

Price fluctuations due to seasonal changes also warrant attention.

For example, buying during off-peak times could result in better deals.

Being strategic about timing can enhance investment returns.

Understanding both micro and macro trends provides a comprehensive view of the market landscape.

By staying informed, we equip ourselves with the knowledge needed to navigate the complexities of real estate investment effectively.

Understanding Zoning Regulations

When we plan to invest in land, zoning regulations are a critical factor that can influence our decision.

They define how we can develop and utilize the property, thus impacting potential profitability.

Types of Zoning

Zoning classifications provide a framework for how land can be used in different areas. Residential, commercial, industrial, and agricultural are the most common zoning categories.

Each category comes with specific restrictions and allowed uses.

For instance, residential zoning may permit single-family homes but exclude multi-family structures.

Meanwhile, commercial zoning allows for businesses and retail, whereas industrial zoning is suited for manufacturing and heavy industries.

Lastly, agricultural zoning is aimed at preserving farming activities and open spaces.

Understanding these classifications helps us determine whether our intended use aligns with local regulations.

Impact on Property Use

Zoning controls significantly affect the ways we can use the land.

By restricting or permitting specific activities, they shape the development potential.

If we wish to change the zoning to better suit our investment plans, we must apply for a variance or rezoning.

However, this can be a lengthy and complex process with no guarantee of approval.

Failure to comply with existing zoning laws can result in legal issues or fines.

Thus, careful examination of zoning regulations is essential before purchase.

Assessing how they affect property use helps us align our investment goals with legal requirements.

Evaluating Soil Quality

Evaluating soil quality is essential for determining the potential of land investments, as soil properties directly influence land productivity and sustainability.

Key focus areas include the practicality of soil testing and prevalent soil-related challenges.

Importance of Soil Testing

Soil testing provides critical insights into nutrient levels, pH balance, and soil composition, enabling informed decision-making.

By identifying deficiencies or toxicities, we can recommend appropriate amendments to optimize soil health.

Regular testing helps monitor changes and ensures that land maintains its productive potential.

Investors should consider hiring experts to conduct soil assessments.

These professionals use advanced techniques and methodologies tailored to specific land types, ensuring accuracy and reliability. Consistent monitoring is vital for maintaining soil fertility and achieving desired land performance outcomes.

Common Soil Issues

Identifying common soil issues such as erosion, compaction, and salinity is vital in land evaluation. Erosion can deplete soil layers, reducing fertility and productivity, while compaction affects root growth and water absorption.

Meanwhile, salinity and acidity problems may hinder plant growth and need addressing through specific restoration efforts.

Understanding local soil challenges allows us to develop targeted management practices.

By doing so, we can maintain soil integrity and foster long-term land sustainability.

Taking proactive measures in addressing these issues is a crucial step for any successful land investment strategy.

Assessing Market Trends

In our exploration of land investment, understanding market trends is crucial.

We need to focus on both the current local conditions and any planned future developments.

Local Market Conditions

When examining local market conditions, we must analyze recent sales data, inventory levels, and pricing trends.

A key element is scrutinizing local sales activity to gauge demand and identify growth patterns.

Interest rates and economic indicators also play significant roles in shaping these market conditions.

Monitoring these trends helps us understand the local economic environment.

Neighborhood dynamics, such as crime rates and school quality, affect property desirability too.

We need to consider all these factors carefully for a comprehensive evaluation of the local real estate market.

Future Development Plans

Future development plans can significantly impact land values and investment potential.

Analyzing municipality plans reveals upcoming infrastructure projects, like new roads or public transport initiatives, boosting property accessibility.

Furthermore, proposed commercial or residential developments provide insights into potential changes in demand.

Tracking zoning changes is equally essential, as they can alter the landscape entirely, affecting property value.

We should stay informed about these plans through local government publications and attend public hearings to understand how future developments will shape the area.

Frequently Asked Questions

When analyzing land for investment, understanding financial metrics and tools is essential for evaluating opportunities.

Below, we discuss key financial considerations and methods used in real estate investment analysis to assess the value and potential returns.

What financial metrics are essential for evaluating land as a viable investment?

To gauge land investment potential, metrics like Return on Investment (ROI) and Net Present Value (NPV) are crucial.

ROI helps us understand the profitability of our investment relative to costs, while NPV provides insights into the value of potential returns in today’s dollars.

How do capitalization rates compare with yield in real estate investment?

Capitalization rates, or cap rates, help us assess the returns of an income-generating property by comparing net income to the purchase price.

Yield, on the other hand, looks at the overall return relative to the purchase price or value.

Knowing the distinction aids in evaluating different aspects of returns.

Which analytical tools should one use for conducting a thorough real estate investment analysis?

Key analytical tools include spreadsheets for financial modeling and software platforms like DealMachine to track key metrics and visualize data.

These resources assist in understanding complex financial information and make forecasts based on various investment scenarios.

What are the implications of the 4-3-2-1 rule in assessing real estate properties?

The 4-3-2-1 rule offers a guideline for land allocation: 40% of investment should go toward location, 30% to the property structure, 20% to interior improvements, and 10% to final touches.

This rule helps us prioritize investment focus based on impact areas.

How do you determine the potential profitability of a rental property investment?

Potential profitability is assessed by examining rental income, operating expenses, and financing costs.

Metrics such as Cash on Cash Return and Gross Rent Multiplier allow us to estimate returns based on cash invested and rental income potential.

What ratios are critical for a comprehensive real estate ratio analysis?

Key ratios include Debt Service Coverage Ratio (DSCR) and Loan-to-Value (LTV).

The DSCR measures cash available to meet debt obligations, while the LTV reflects the loan amount relative to the property’s value.

These ratios contribute to a solid understanding of financial health and risk.